- What's the price of bitcoin

- Bit price

- Baby bitcoin where to buy

- How does bitcoin make money

- Cryptocom transfer to wallet

- When will all btc be mined

- Cryptocurrency bitcoin price

- How many btc are there

- Solana crypto price

- Ore mine btc

- Will crypto bounce back

- Bitcoin price prediction for tomorrow

- Bitcoin cryptocurrency

- Buy physical bitcoin

- Crypto com not working

- Buy bitcoin cash

- Crypto interest

- Free dogecoin

- Cryptocom security

- Btc live price

- Crypto com support

- Crypto mining

- Buy cryptocurrency

- How does bit coin work

- Coinbase to invest all future crypto

- Google bitcoin

- Safemoon crypto price

- Bitcoin trend

- Algo crypto price

- Dogecoin volume

- Best crypto to buy

- How is crypto taxed

- Lightcoin price usd

- Coinbase win dogecoin

- Bitcoin mining free

- Buy tether

- Emax crypto price

- Crypto nft app

- How does btc mining work

- Where to buy new crypto coins

- Free btc

- How to buy dogecoin stock on coinbase

- Visa bitcoin to work with exchanges

- Create cryptocurrency

- How much to buy dogecoin

- Btc prices

- Doge crypto

- Shiba inu coin cryptocurrency

- How to transfer money from cryptocom to bank account

- Crypto exchange

- Way senate melted down over crypto

- Bitcoin apps

- How much is bitcoin

- Btc address lookup

- Squid game cryptocurrency price

- New crypto to buy

- Cryptocom verification process

- Time wonderland crypto

- Where to buy crypto

- How much is bitcoin today

- Cryptocom unsupported currency

- Cryptocom shiba inu

- Solo crypto

- Crypto com referral

- 1 btc in usd

- Ethereum nft whale

- Coinbase cryptocurrency prices

Stock flow model bitcoin

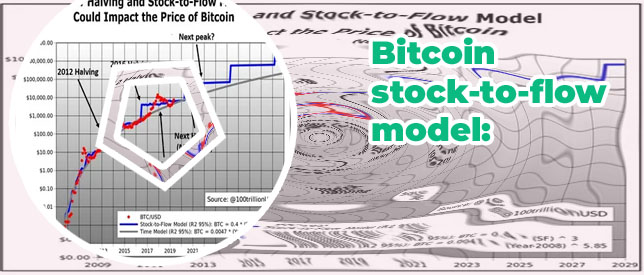

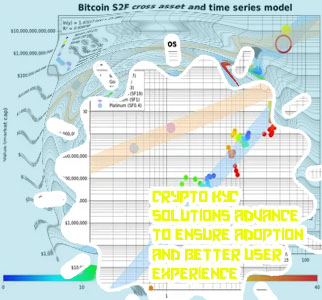

Understanding the stock flow model of Bitcoin is crucial for investors and analysts looking to predict the future price movements of the cryptocurrency. By examining the relationship between the circulating supply of Bitcoin and its rate of production, one can gain valuable insights into its value proposition and potential for long-term growth. To further explore this topic, here are two articles that delve into the intricacies of the stock flow model and its implications for Bitcoin.

Decoding the Stock-to-Flow Model: A Key to Bitcoin's Price Potential

Today we are going to talk about the Stock-to-Flow model and its implications for Bitcoin's price potential. The Stock-to-Flow model is a popular metric used to evaluate the scarcity of an asset, particularly in the context of Bitcoin. This model takes into account the existing supply of Bitcoin (stock) and the new supply entering the market (flow) to determine its scarcity.

The Stock-to-Flow model suggests that as Bitcoin's supply becomes more limited over time, its price could potentially increase significantly. This is based on the idea that scarcity drives value, and Bitcoin's fixed supply cap of 21 million coins makes it a scarce asset compared to traditional fiat currencies.

By analyzing historical data and trends, researchers have found a strong correlation between Bitcoin's price movements and the Stock-to-Flow model. This has led many to believe that Bitcoin's price could reach new heights in the future as its scarcity continues to increase.

Understanding the Stock-to-Flow model is crucial for investors and traders looking to capitalize on Bitcoin's price potential. By incorporating this metric into their analysis, they can gain valuable insights into the factors driving Bitcoin's price movements and make more informed investment decisions.

Analyzing the Impact of Halving Events on Bitcoin's Stock Flow Model

As a seasoned cryptocurrency analyst based in Tokyo, Japan, I found the recent study on the impact of halving events on Bitcoin's stock flow model to be incredibly insightful. The research delves deep into the relationship between the scarcity of Bitcoin and its price dynamics, shedding light on how the supply reduction caused by halving events can influence market behavior.

The study's findings suggest that the stock-to-flow model, which measures the ratio of existing supply to new production, plays a crucial role in determining Bitcoin's value. By analyzing past halving events, the researchers were able to identify a clear pattern of price appreciation following these supply shocks. This underscores the importance of understanding the underlying fundamentals of Bitcoin's protocol and how they interact with market forces.

Feedback from a resident of London, England, further emphasizes the significance of this research. James Fraser, a financial advisor in the city, notes that the stock-to-flow model has become increasingly popular among investors looking to gauge the future performance of Bitcoin. He adds that the study provides valuable insights into how halving events can act as catalysts for price rallies, highlighting the need for a comprehensive understanding of the cryptocurrency market.

Overall, this study serves as a valuable resource for both seasoned investors and newcomers looking to navigate the complexities of the cryptocurrency space. Its