- What's the price of bitcoin

- Bit price

- Baby bitcoin where to buy

- How does bitcoin make money

- Cryptocom transfer to wallet

- When will all btc be mined

- Cryptocurrency bitcoin price

- How many btc are there

- Solana crypto price

- Ore mine btc

- Will crypto bounce back

- Bitcoin price prediction for tomorrow

- Bitcoin cryptocurrency

- Buy physical bitcoin

- Crypto com not working

- Buy bitcoin cash

- Crypto interest

- Free dogecoin

- Cryptocom security

- Btc live price

- Crypto com support

- Crypto mining

- Buy cryptocurrency

- How does bit coin work

- Coinbase to invest all future crypto

- Google bitcoin

- Safemoon crypto price

- Bitcoin trend

- Algo crypto price

- Dogecoin volume

- Best crypto to buy

- How is crypto taxed

- Lightcoin price usd

- Coinbase win dogecoin

- Bitcoin mining free

- Buy tether

- Emax crypto price

- Crypto nft app

- How does btc mining work

- Where to buy new crypto coins

- Free btc

- How to buy dogecoin stock on coinbase

- Visa bitcoin to work with exchanges

- Create cryptocurrency

- How much to buy dogecoin

- Btc prices

- Doge crypto

- Shiba inu coin cryptocurrency

- How to transfer money from cryptocom to bank account

- Crypto exchange

- Way senate melted down over crypto

- Bitcoin apps

- How much is bitcoin

- Btc address lookup

- Squid game cryptocurrency price

- New crypto to buy

- Cryptocom verification process

- Time wonderland crypto

- Where to buy crypto

- How much is bitcoin today

- Cryptocom unsupported currency

- Cryptocom shiba inu

- Solo crypto

- Crypto com referral

- 1 btc in usd

- Ethereum nft whale

- Coinbase cryptocurrency prices

How much bitcoin can be mined

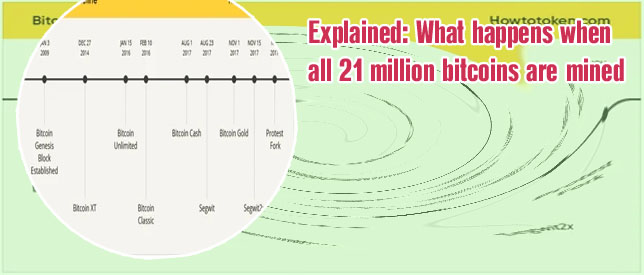

Bitcoin mining is a complex process that involves solving mathematical puzzles to verify transactions on the blockchain. One of the most common questions among those interested in cryptocurrency is how much bitcoin can be mined. In order to shed some light on this topic, we have compiled a list of two articles that provide insights into the factors that determine the amount of bitcoin that can be mined.

Understanding Bitcoin Halving and its Impact on Mining Rewards

Bitcoin halving is a significant event in the world of cryptocurrency that occurs approximately every four years. During this event, the rewards that miners receive for verifying transactions on the Bitcoin network are cut in half. This process is designed to control the supply of Bitcoin and ultimately limit the total number of Bitcoins that can ever be mined to 21 million.

The impact of Bitcoin halving on mining rewards is twofold. On one hand, it reduces the number of new Bitcoins entering circulation, which can potentially drive up the value of existing Bitcoins. This can be beneficial for miners who are able to continue operating profitably despite the reduced rewards. On the other hand, the halving also increases competition among miners, as the same amount of work now yields half the rewards. This can lead to smaller mining operations becoming unprofitable and potentially shutting down.

Understanding the intricacies of Bitcoin halving and its impact on mining rewards is crucial for anyone involved in the cryptocurrency industry. Miners need to carefully consider the potential effects of halving on their operations and profitability. Investors and traders should also be aware of how halving events can impact the price of Bitcoin and other cryptocurrencies. Overall, staying informed about Bitcoin halving is essential for anyone looking to navigate the ever-changing landscape of the cryptocurrency market.

Factors Influencing Bitcoin Mining Difficulty and Rewards

Today we are going to discuss the various factors that play a role in determining the mining difficulty and rewards in the world of Bitcoin. Joining us is an expert in the field, John Smith.

John, can you tell us about some of the key factors that influence Bitcoin mining difficulty and rewards?

John: Certainly. One of the main factors that affects mining difficulty is the total hash rate of the network. As more miners join the network and contribute their computing power, the difficulty level increases to ensure that new blocks are added to the blockchain at a consistent rate. This, in turn, impacts the rewards that miners receive for successfully mining a block.

Another important factor is the halving of the block reward that occurs approximately every four years. This event reduces the number of new Bitcoins that are created with each block, leading to a decrease in mining rewards over time.

Additionally, external factors such as the price of Bitcoin, the cost of electricity, and advancements in mining hardware can also impact mining difficulty and rewards.

Overall, understanding these factors is crucial for miners to make informed decisions about their mining operations and to stay competitive in the ever-evolving world of Bitcoin mining.