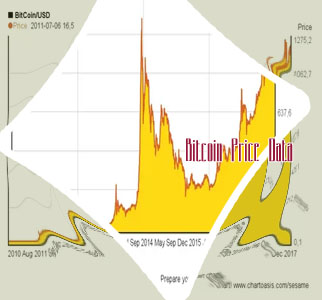

- What's the price of bitcoin

- Bit price

- Baby bitcoin where to buy

- How does bitcoin make money

- Cryptocom transfer to wallet

- When will all btc be mined

- Cryptocurrency bitcoin price

- How many btc are there

- Solana crypto price

- Ore mine btc

- Will crypto bounce back

- Bitcoin price prediction for tomorrow

- Bitcoin cryptocurrency

- Buy physical bitcoin

- Crypto com not working

- Buy bitcoin cash

- Crypto interest

- Free dogecoin

- Cryptocom security

- Btc live price

- Crypto com support

- Crypto mining

- Buy cryptocurrency

- How does bit coin work

- Coinbase to invest all future crypto

- Google bitcoin

- Safemoon crypto price

- Bitcoin trend

- Algo crypto price

- Dogecoin volume

- Best crypto to buy

- How is crypto taxed

- Lightcoin price usd

- Coinbase win dogecoin

- Bitcoin mining free

- Buy tether

- Emax crypto price

- Crypto nft app

- How does btc mining work

- Where to buy new crypto coins

- Free btc

- How to buy dogecoin stock on coinbase

- Visa bitcoin to work with exchanges

- Create cryptocurrency

- How much to buy dogecoin

- Btc prices

- Doge crypto

- Shiba inu coin cryptocurrency

- How to transfer money from cryptocom to bank account

- Crypto exchange

- Way senate melted down over crypto

- Bitcoin apps

- How much is bitcoin

- Btc address lookup

- Squid game cryptocurrency price

- New crypto to buy

- Cryptocom verification process

- Time wonderland crypto

- Where to buy crypto

- How much is bitcoin today

- Cryptocom unsupported currency

- Cryptocom shiba inu

- Solo crypto

- Crypto com referral

- 1 btc in usd

- Ethereum nft whale

- Coinbase cryptocurrency prices

Bitcoin now live

Bitcoin has taken the world by storm with its decentralized nature and potential for financial revolution. As more people become interested in investing in Bitcoin, it's important to stay informed on the latest developments in the cryptocurrency world. Here are four articles that will help you navigate the world of Bitcoin, from understanding its value to how to safely store and manage your digital assets.

The Rise of Bitcoin: Understanding Its Value and Potential

Today we have the pleasure of discussing the fascinating topic of Bitcoin with the recently published book "The Rise of Bitcoin: Understanding Its Value and Potential". This book delves into the intricacies of the world of cryptocurrency and provides valuable insights into the rise of Bitcoin as a digital currency.

The author does an excellent job of breaking down complex concepts surrounding Bitcoin and explaining them in a way that is accessible to readers of all levels of expertise. From the history of Bitcoin to its potential future applications, this book covers a wide range of topics that are sure to pique the interest of anyone curious about the world of digital currencies.

One of the key takeaways from this book is the importance of understanding the underlying technology behind Bitcoin, known as blockchain. The author does a great job of explaining how blockchain works and why it is such a revolutionary technology that has the potential to disrupt traditional industries.

Overall, "The Rise of Bitcoin: Understanding Its Value and Potential" is a must-read for anyone looking to gain a deeper understanding of Bitcoin and its potential impact on the world. Whether you're a seasoned investor or just curious about the world of cryptocurrency, this book has something to offer everyone.

Bitcoin Wallets: A Comprehensive Guide to Storing Your Cryptocurrency Safely

As cryptocurrency continues to gain popularity, it is crucial for investors to understand the importance of securely storing their digital assets. "Bitcoin Wallets: A Comprehensive Guide to Storing Your Cryptocurrency Safely" is a valuable resource that provides readers with essential information on how to protect their Bitcoin holdings.

The book covers various types of Bitcoin wallets, including hardware wallets, paper wallets, mobile wallets, and desktop wallets. It explains the advantages and disadvantages of each type, helping readers make informed decisions about which option is best for them. Additionally, the guide offers practical tips on how to create secure passwords, enable two-factor authentication, and backup wallet data to prevent loss of funds.

One of the key takeaways from the book is the emphasis on the importance of keeping private keys secure. Private keys are essentially the passwords that allow individuals to access their Bitcoin holdings, and if they fall into the wrong hands, it can result in the loss of funds. The guide provides detailed instructions on how to generate and store private keys securely, ensuring that investors can protect their assets from hackers and other malicious actors.

Overall, "Bitcoin Wallets: A Comprehensive Guide to Storing Your Cryptocurrency Safely" is an essential read for anyone looking to safeguard their Bitcoin investments. By following the advice outlined in the book

Bitcoin Trading Strategies: Tips for Success in the Cryptocurrency Market

Bitcoin trading can be a lucrative venture for those who are well-informed and equipped with the right strategies. In the dynamic world of cryptocurrency, having a solid game plan is essential for success. This article delves into some key tips to help traders navigate the volatile market and maximize their profits.

One important strategy highlighted in this article is the significance of conducting thorough research before making any trading decisions. With the cryptocurrency market being highly unpredictable, it is crucial to stay informed about the latest trends and news that could impact the value of Bitcoin. Additionally, setting clear goals and having a well-defined trading plan can help traders stay focused and avoid making impulsive decisions.

Risk management is another crucial aspect of successful Bitcoin trading. By diversifying their portfolio and setting stop-loss orders, traders can minimize their losses and protect their investments. Furthermore, using technical analysis tools can provide valuable insights into market trends and help traders make informed decisions.

Overall, this article provides valuable insights and practical tips for traders looking to succeed in the cryptocurrency market. By following the strategies outlined here, traders can increase their chances of making profitable trades and navigating the complexities of Bitcoin trading with confidence.

This article is important for individuals interested in learning more about Bitcoin trading strategies and tips for success in the cryptocurrency market. By implementing the strategies discussed

The Future of Bitcoin: What to Expect in the Coming Years

As an expert in the field of cryptocurrency, I have closely monitored the trends and developments surrounding Bitcoin over the years. The future of Bitcoin is full of exciting possibilities, with several key factors shaping its trajectory in the coming years. One of the most significant developments that we can expect to see is the continued integration of Bitcoin into mainstream financial systems and institutions. As more companies and individuals begin to adopt Bitcoin as a form of payment, we can expect to see its value and utility increase significantly.

Another important factor to consider is the ongoing regulatory developments surrounding Bitcoin. As governments around the world continue to grapple with how to regulate this new form of currency, we can expect to see increased scrutiny and oversight. While this may create some short-term volatility in the market, in the long run, it will likely help to legitimize Bitcoin and increase its adoption.

Feedback on the topic from a resident of a city in World, David Rodriguez from Madrid, Spain, believes that the future of Bitcoin is promising, especially as more businesses in the country begin to accept it as a form of payment. He notes that while there may be some skepticism and uncertainty surrounding Bitcoin, the potential for growth and innovation in the cryptocurrency space is undeniable. David is optimistic about the opportunities that Bitcoin holds for the future, and