- What's the price of bitcoin

- Bit price

- Baby bitcoin where to buy

- How does bitcoin make money

- Cryptocom transfer to wallet

- When will all btc be mined

- Cryptocurrency bitcoin price

- How many btc are there

- Solana crypto price

- Ore mine btc

- Will crypto bounce back

- Bitcoin price prediction for tomorrow

- Bitcoin cryptocurrency

- Buy physical bitcoin

- Crypto com not working

- Buy bitcoin cash

- Crypto interest

- Free dogecoin

- Cryptocom security

- Btc live price

- Crypto com support

- Crypto mining

- Buy cryptocurrency

- How does bit coin work

- Coinbase to invest all future crypto

- Google bitcoin

- Safemoon crypto price

- Bitcoin trend

- Algo crypto price

- Dogecoin volume

- Best crypto to buy

- How is crypto taxed

- Lightcoin price usd

- Coinbase win dogecoin

- Bitcoin mining free

- Buy tether

- Emax crypto price

- Crypto nft app

- How does btc mining work

- Where to buy new crypto coins

- Free btc

- How to buy dogecoin stock on coinbase

- Visa bitcoin to work with exchanges

- Create cryptocurrency

- How much to buy dogecoin

- Btc prices

- Doge crypto

- Shiba inu coin cryptocurrency

- How to transfer money from cryptocom to bank account

- Crypto exchange

- Way senate melted down over crypto

- Bitcoin apps

- How much is bitcoin

- Btc address lookup

- Squid game cryptocurrency price

- New crypto to buy

- Cryptocom verification process

- Time wonderland crypto

- Where to buy crypto

- How much is bitcoin today

- Cryptocom unsupported currency

- Cryptocom shiba inu

- Solo crypto

- Crypto com referral

- 1 btc in usd

- Ethereum nft whale

- Coinbase cryptocurrency prices

Plan b october bitcoin prediction

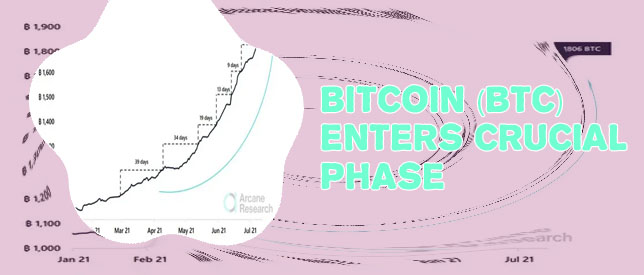

Bitcoin enthusiasts are always on the lookout for predictions and forecasts about the future of the cryptocurrency market. With October just around the corner, many are wondering what lies ahead for Bitcoin and whether it is a good time to invest or trade. To help shed some light on the topic of Plan B's October Bitcoin prediction, here are three articles that delve into the subject and offer valuable insights.

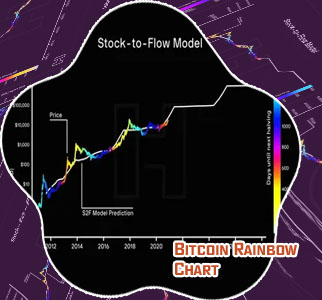

Analyzing Plan B's Stock-to-Flow Model for Bitcoin Price Prediction in October

The Stock-to-Flow (S2F) model, developed by anonymous analyst Plan B, has gained significant attention in the world of cryptocurrency. This model predicts the price of Bitcoin based on its scarcity, as measured by its stock-to-flow ratio. In October, the S2F model suggested that Bitcoin's price could reach new heights, potentially surpassing 0,000.

The S2F model has been praised for its accuracy in predicting Bitcoin's price movements in the past. However, critics argue that the model may oversimplify the complex factors that influence the cryptocurrency market. Despite this, the S2F model continues to be a popular tool for traders and investors looking to forecast Bitcoin's price trajectory.

In order to better understand the implications of the S2F model for Bitcoin price prediction, it is important to consider the historical accuracy of the model, as well as any potential limitations or weaknesses. Additionally, exploring the impact of external factors such as regulatory developments and market sentiment on Bitcoin's price could provide valuable insights into the model's reliability.

Overall, the S2F model offers a unique perspective on Bitcoin price prediction, but should be used in conjunction with other analysis methods for a comprehensive understanding of the market.

Expert Opinions on the Accuracy of Plan B's Bitcoin Predictions for October

In recent years, Bitcoin has become a popular topic of discussion among investors, traders, and analysts. With its volatile nature and potential for high returns, many experts have tried to predict its future price movements. One such expert is Plan B, who is known for his stock-to-flow model that he uses to forecast Bitcoin prices.

For the month of October, Plan B predicted that Bitcoin would reach a price of ,000. However, as the month unfolded, Bitcoin failed to reach this target and instead hovered around the ,000 mark. This discrepancy in price has led many to question the accuracy of Plan B's predictions.

Several experts have weighed in on the matter, with some expressing skepticism about the reliability of Plan B's model. They argue that while the stock-to-flow model has been accurate in the past, it may not be able to account for all the factors that can influence Bitcoin's price movements. Others believe that Plan B's predictions are still valid, but that they should be taken with a grain of salt.

Overall, the debate over the accuracy of Plan B's Bitcoin predictions for October highlights the challenges of forecasting the price of such a volatile asset. It also underscores the importance of considering multiple sources of information when making investment decisions in the cryptocurrency market.

Factors Influencing Bitcoin's Price Movement in October and How it Aligns with Plan B's Prediction

Bitcoin's price movement in October was influenced by a variety of factors that aligned with Plan B's prediction of the cryptocurrency's trajectory. One major factor was the ongoing global economic uncertainty due to the COVID-19 pandemic, which led investors to seek alternative assets like Bitcoin as a hedge against inflation and market volatility. Additionally, the increasing adoption of Bitcoin by institutional investors and payment platforms boosted its legitimacy and mainstream acceptance, driving up demand and consequently prices.

Another key factor was the anticipation of Bitcoin's halving event in May, which reduced the supply of new coins entering the market and historically led to price surges in the following months. This scarcity effect, combined with growing interest from retail traders and tech-savvy millennials, created a perfect storm for Bitcoin's price appreciation in October.

Moreover, regulatory developments such as the approval of Bitcoin ETFs and futures trading further solidified its status as a legitimate investment vehicle, attracting more institutional capital and paving the way for future price growth. Overall, these factors contributed to Bitcoin's price movement in October and supported Plan B's prediction of a continued upward trend for the cryptocurrency.

Key factors influencing Bitcoin's price movement in October:

- Global economic uncertainty

- Institutional adoption

- Halving event

- Retail trader interest